Value Creation

WACC = Weighted Average Cost of Capital

ROIC = Return On Invested Capital

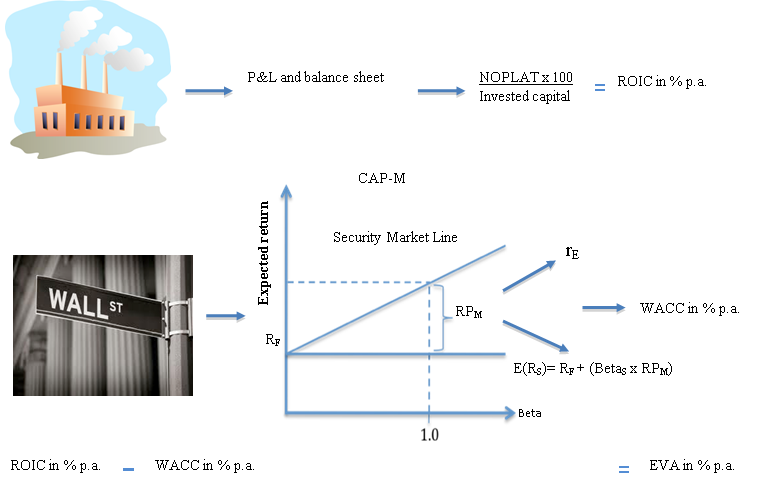

The top of the illustration shows that the company through its annual profit and loss accounts and balance sheets generates an overall profitability percent called ROIC (= Return On Invested Capital). The bottom of the illustration depicts how the stock market investors through the so-called CAP-M model require a minimum yield expressed as WACC in percent in order to invest in the company’s shares.

WACC stands for Weighted Average Cost of Capital and is the stock market’s weighted risk-adjusted minimum required yield consisting of the required equity capital yield and the required yield on the debt.

When this WACC is deducted from the ROIC, the result is EVA. If the EVA is positive, the company generates real economic value creation (= Economic Value Added) to its owners. Thus, EVA equals the company’s excess (or less) earnings compared to the stock market’s risk-adjusted minimum required yield of return, WACC.

EVA can be expressed in percentage, as explained above, but it can also be expressed in DKK in two different ways, i.e. EVA in DKK = EVA in % x Invested capital (=total balance sheet), and EVA in DKK = NOPLAT – (Invested capital x WACC).

Although many business owners have never heard of WACC, it is a concept that has great practical importance for their business.

If the company does not generate a percentage return on its existing total or separate investments and activities or on new investments and activities that at least equals the size of the WACC, the investments are in fact unprofitable seen from a market value perspective.

Therefore, such investments will year after year be value destructive and they will systematically reduce the market value of its equity capital.