EVA Specifically

Several hundred value drivers to reliazation of EVA!

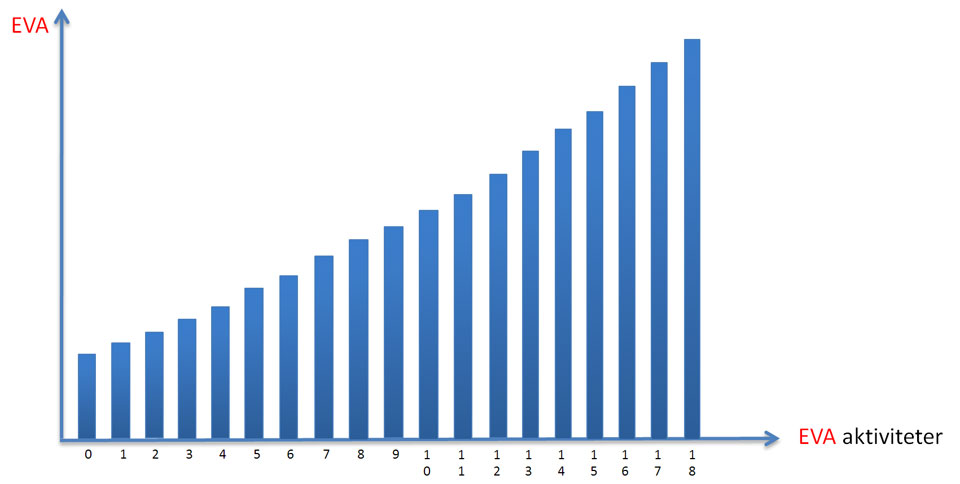

Value creation expressed as EVA in the individual company is in the book illustrated as in the figure below. On the vertical axis, you find value creation, EVA, which can be performed by using several hundred so-called value drivers, which are divided into three main groups: the direct economic value drivers, the indirect value drivers and the strategic value drivers. Operationally, CDI Global has divided them into the figure’s 18 EVA activities.

0. Indicative valuation, cf. chapter 5.

1. EVA through improvements in the direct economic value drivers, cf. Table 4.

2. EVA through improvements in the indirect economic value drivers, cf. chapter 6.

3. EVA through improvements in operational, profitability and other financial key figures

and profit margins, etc., cf. table 8.

and profit margins, etc., cf. table 8.

4. EVA through risk and WACC reducing activities and capital structure changes.

5. EVA through improvements in dozens of internal strategic value drivers, cf. chapter 6.

5. EVA through improvements in dozens of internal strategic value drivers, cf. chapter 6.

6. EVA through improvements in dozens of external strategic value drivers, cf. chapter 6.

7. EVA through improvements in dozens of mixed strategic value drivers, cf. chapter 6.

8. EVA through improvements in dozens of overall strategic value drivers, cf. chapter 6.

9. EVA through the development of scenarios and strategies as illustrated in tables 14–16.

7. EVA through improvements in dozens of mixed strategic value drivers, cf. chapter 6.

8. EVA through improvements in dozens of overall strategic value drivers, cf. chapter 6.

9. EVA through the development of scenarios and strategies as illustrated in tables 14–16.

10. EVA through six CDI concepts:

Value and Service Check, Sales Maturation, Value Optimization, Strategy Development& Strategy Diagnosis, Value Creation and Perfect Match.

11. EVA by derivation and valuation of as well as dealing with synergies, cf. figure 9.

11. EVA by derivation and valuation of as well as dealing with synergies, cf. figure 9.

12. EVA through analysis and ensuring that existing total and separate investments and

activities as well as new investments and activities generate a return that is greater than the WACC.

13. EVA through reduction of invested capital with the same/ better earnings (segregation, divestment and closures, etc.)

13. EVA through reduction of invested capital with the same/ better earnings (segregation, divestment and closures, etc.)

14. EVA through the good CDI business acumen based on experience from more than 100 purchase, sale and M&A transactions.

15. EVA through IPOs.

16. EVA through M&A´s in order to realize synergies, cf. figure 9.

15. EVA through IPOs.

16. EVA through M&A´s in order to realize synergies, cf. figure 9.

17. EVA through Investor Relations Activities.

18. EVA through management incentive programmes.

The figure clearly illustrates that there are significant opportunities to generate value creation in the form of EVA (= higher market value of the equity capital) with the several hundreds different value drivers.